Review of 2023

Shaping the Future of Cash in an Uncertain World

The Future of Cash conference in Istanbul saw some big conversations about cash today and its future. The mood was more upbeat than in recent years as transactional demand for cash has largely rebounded from the lows of the pandemic and the access to cash agenda has gathered pace in countries facing the reality of less cash.

Access to the presentations is limited to FOC 2023 attendees, please use the password which was provided by the events@recon-intl.com

Opening seminar – Cash as a public good, a basic right

The opening seminar addressed whether cash was a public good or a basic right. Héctor Labat from CashEssentials opened with a literature review of the topic, and this was followed by presentations by Tim Stuchtey of the Brandenburg Institute for Society and Security (BIGS) and Frédéric Allemand from the University of Luxembourg, Carin van der Cruijsen from de Nederlandsche Bank, Franz Seitz from the Weiden technical University of Applied Sciences and Ursula Dalinghaus from Ripon College. This interdisciplinary approach illustrated how some of the unique attributes of cash – resilience, inclusion, economic stability and public money – clearly contribute to public good.

While no definitive conclusion was reached, the room changed from an initial view that cash is a public good to one that cash is a basic right. It appears that cash does not meet the non-rivalrous criteria of the economic definition of a public good, i.e. the consumption by one individual does not deprive others.

Some time was spent on the cost of cash and the issue of surcharging, i.e. charging consumers directly for the cost of payment. In New York State, receipts show the card processing fees paid by merchants. From albeit anecdotal comments from the audience, it appears it is becoming common for restaurants to have a cash price and a digital payment price. The Frankfurter Allgemeine paper has also reported on this in Germany recently. This became a requirement in Canada from October 2022. When these costs are pointed out to consumers, their payment behaviour changes.

Setting the scene

The Central Bank of Türkiye introduced the dynamics of its cash cycle and the challenges of managing cash in a country with high levels of inflation. While people store value in foreign currency, cash is still required for transactions although the denominational mix changes quickly. The number of banknotes increased from 1.2 billion in 2013 to 4.8 billion today, with 67% of the volume in the highest denomination.

The Federal Reserve posed the question about whether cash in the US has reached a strategic inflexion point. Dynamic volumes, the cash paradox and rising costs are combining to create uncertainty. The Fed is investing significantly in its printing facilities, vaults, processing machines, automation and is planning to release a new series of banknotes. The private sector however has moved away from investing in the cash infrastructure to investing in all things digital.

Finally, the European Central Bank (ECB) presented on its 2030 Cash Strategy. Perhaps a key point made was that both transactions and the store of value function need to work well to ensure its resilience. The draft EU regulation on the legal tender of cash will require member states to monitor access to cash e.g. by measuring the geographical coverage and capacity of ATM networks; some countries are already taking policy measures to mandate that banks ensure access.

Understanding the cash paradox

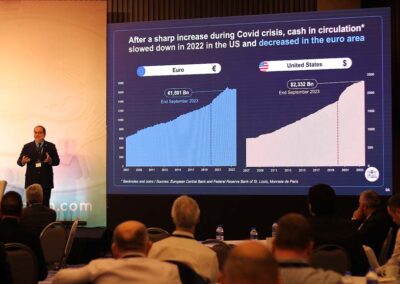

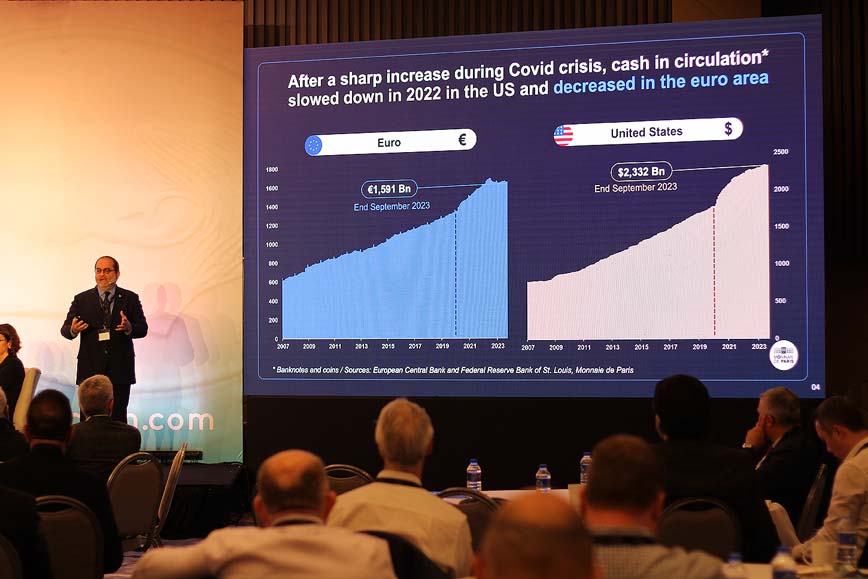

Antti Heinonen analysed cash in circulation data from around the world to provide the hard data for many much talked about observations – that banknote growth rates returned to normal in 2021, following exceptional growth in 2020 that accumulated cash stocks have not returned to central banks and that a combination of inflation and higher interest rates have reduced cash demand. Perhaps a key observation was that recent events don’t suggest that the trust in physical cash can be transferred easily in a crisis into a digital currency.

Magyar Nemzeti Bank (MNB) described its technique for determining cash demand patterns. The ratio of income to total value of transactions gives the velocity of money This indicator can be used to filter out the income effect of cash demand using this in its analysis of recent events, MNB has determined that a turbulent economic situation results in permanently high cash holdings regardless of a macroeconomic environment that encourages a decrease in cash holdings.

Monnaie de Paris reported on its annual IFOP survey on the usage and perception of cash in France. As ever the results showed considerable affection for cash and a high level of usage. There have been quite large increases in the preference of cash for precautionary holdings (61% in 2021, 67% in 2023) and budgeting (52% in 2021, 61% in 2023).

Cash cycle in a digital world

NatWest, one of the UK’s big four high street banks, explained its work on cash. This is driven both by its own customer research and the need to work with the UK’s new legislation on access to cash.

The focus is very much on helping customers with the transition to a digital world. In the short term NatWest is actively looking to support customers with adapting to digital solutions, to maintain access to cash by more automation, the provision of local services and supporting the development of banking hubs. It is looking to reduce costs and increase efficiency, while maintaining cash provisions, through shared wholesale infrastructure and, possibly, a utility model for ATMs.

Meanwhile SBV Services and BankservAfrica described the complex and challenging cash environment in South Africa. They described a society that is becoming both digital and cash based. Things are changing and innovation and co-operation by and between stakeholders will help meet changing consumer behaviour.

Round table conversations

Seven topics were chosen with a facilitator introducing each one. Delegates self-selected two which they wanted to join to spend 45 minutes discussing and debating key points. This was an opportunity to learn, to challenge and to think with others about key cash related topics.

While some were, perhaps, obvious – for example access to cash, acceptance of cash, redesigning the cash cycle, cash and CBDCs – others were less so – how to fund the cash cycle, CashTech and Innovation Sustainability, cash and crises.

The results of the discussions were fed back in a separate session but it was clear that lively debate had ensued and this was a valuable session.

Sustainability

Christopher Baud-Berthier, Director Cash Department, laid out the Banque de France’s (BdF) work on sustainability across production, distribution and end of life.

In 2023, BdF moved to using 100% sustainable cotton. By 2025 65% of its cotton will be organic or fairtrade and by 2027 this will be 100%. It has made major changes resulting in reducing its CO2 emissions from printing operations by 30% between 2019 and 2022. BdF is creating a new print works. It has set itself the goal of reducing emissions by 2026 by 50% compared with 2019.

Management Models

Bantas, owned by three major banks in Türkiye, provides cash processing, cash in transit, ATM, branch and retail services. The starting point of this presentation was that banks currently pay 65% of the cost of providing cash, retailers pay 25% and central banks the rest. 20-30% of the cost of cash operations can be saved through multi-bank collaboration by eliminating inefficiencies, economies of scale, focus and transferring risks.

As the presentation demonstrated, this is not straightforward, but it is possible, and the benefits are real.

Redesigning the cash cycle

The Dutch National Bank (DNB) presented the Dutch experience of dealing with the realities of a less cash world, particularly the withdrawal of commercial banks from cash services. While the creation of a utility ATM model based on Geldmaat has been one part of the story, the Dutch Treasury has also been prepared to bring forward legislation to support access to cash. Currently a ‘covenant’ model is in place between cash stakeholders. This has not proved enough to safeguard access to cash and a robust cash infrastructure.

The Bundesbank described a major two year research project looking at the future of cash in Germany. No results are yet available.

The Royal Canadian Mint reported on the recent Mint Director’s Conference (MDC), on its sustainability actions and what research into Canadian’s payment methods and trends says about the future of coins.

The MDC identified the risks of insufficient availability of cash driven by digital payments displacing cash leading to a risk of increased social and economic inequality. This highlighted the importance of a multi payment system where cash co-exists with e-payments.

The Canadian payment survey confirmed cash as remaining relevant to daily life and commerce, particularly for low value transactions. Inflation and the cost of living challenges may lead to hoarded coins being spent. Cash acceptance is not a significant issue. Now that credit card surcharge fees are visible, this could lead to more cash and debit card usage. Most Canadians do not plan to go cashless.

Resilience by design

Resilience is currently an important area of interest in the face of a series of natural disasters and a range of conflicts around the world. In every case, cash plays an important role. This session saw the Brandenburg Institute for Society and Security describe an important piece of research that it is has done in this area in co-operation with the Bundesbank, and further work planned.

James Shepherd-Baron, a disaster risk consultant, talked about his real life experience of the role and importance of cash in disaster areas.

Finally, Alper Sayin from Garanti BBVA gave the real life example of what happened in Türkiye when earthquakes struck the country in February this year. This was an outstanding story of how well prepared and carefully rehearsed plans actually worked when earthquakes that killed 60,000 people and put two cash centres completely out of action hit the country.

A new approach to making the case for cash

Brett Scott, the author, explained how the digital leaders have created and driven the story that digital is good and analogue is bad. He used the work of Visa and Mastercard in the payment landscape to illustrate what has been done, and to challenge the audience to think about regaining control and changing the conversation.

If one argues for cash in the context of the digital narrative, the chances of breaking through are significantly less than if the debate is reframed. Key ideas lie in autonomy compared with dependence, public infrastructure v private infrastructure and the broad limitations of a digital world.

The conference room split into working groups to see if they could devise a billboard, social media campaign or guerilla marketing campaign to present cash as a positive choice without falling back into a defensive crouch shaped by the war on cash.

It was a fascinating exercise which revealed real creativity, ranging from Banksy style artwork with cash presented in the image and a Tik Tok series of clips showing cash being used in situations where only cash works well. Potential slogans such as ‘Cash: more than a beer token’ and an image of Visa’s annual profit and the line, ‘nothing is for free’ do not make the public space! They should. Innovation

The final session of the conference focused on innovation including three awards, sponsored by Sesami, which went to:

- Best CashTech Innovator Winner: Managecash Personal

Managecash Personal was created by Otokod Technologies from Türkiye. It is an app-based solution enabling consumers to seamlessly access cash from shops or individuals, using a QR code. No POS terminal or hardware is required. - Best CashTech Start-Up Winner: Cash Perks

Cash Perks offers a unique and convenient method for providing instant access to cash to anyone, anytime and anywhere. This cost-effective solution facilitates cash disbursement through SMS. Recipients can then use the credentials provided within the text messages to withdraw allocated funds immediately at local ATMs nationwide, without the need for a bank card or app. - Best CashTech Award Winner: Donation Dollar by the Royal Australian Mint

The Donation Dollar was first released in 2020 as a vehicle for all Australians to engage in a moment of generosity, prompted by a simple $1 coin. The intention is to promote charitable behaviour and to provide a tangible, accessible way for people – who have the means – to enjoy the benefit of giving a small amount more frequently. One Donation Dollar has been minted for every Australian as a reminder of the importance of giving back. Donation Since its release, the Donation Dollar generated an additional $55m in incremental charitable giving and this will only increase in future years.

Also in this session, Banco de España presented its Neurocash solution for helping banknote designers optimise the reaction of banknote users to their design. A perception study combined with tracking the physiological response and human behaviour tracking of people reveals their implicit and explicit reaction to a design. This offers benefits in production, the reaction to faults, circulation and communication campaigns.

On cash cycle optimisation, Barry Röhrs presented on a methodology for analysing cash and cash cycles that has been used in South Africa and elsewhere. The approach has been designed to identify opportunities to innovate to achieve objectives such as increasing efficiency in the cash cycle or allowing cash and digital payments to work together.

Final word

The content and approach of this conference was not just recording where we are and bemoaning why were aren’t where we want to be. It asked real questions and offered case studies of different approaches, initiatives and strategies. It covered everything from policy to sustainability to efficiency. A very useful and unique event in the conference calendar.

2023 ATTENDEES

Banco de España

Spain

Bangko Sentral ng Pilipinas

Philippines

Bank Indonesia

Indonesia

Bank of England

England

Bank of Finland

Finland

Bank of Zambia

Zambia

BankservAfrica

South Africa

Banque de France

France

Bantas

Türkiye

BNP Paribas

France

Cash Consult Middle East FZ LLE

Dubai

CashEssentials

France

Central Bank of Oman

Oman

Central Bank of Türkiye

Türkiye

CMS Analytics

UK

De Nederlandsche Bank

Netherlands

Department of Sociology and Anthropology, Ripon College

USA

Deutsche Bundesbank

Germany

Disaster Risk Management Consultant

UK

European Central Bank

Germany

Federal Reserve Financial Services

USA

GarantiBBVA

Türkiye

GRG Bankacılık Ekipmanları Ltd. Şti.

Turkey

International Association of Currency Affairs

İşbank

Turkey

Kuwait Oil Company

Kuwait

LINK ATM Scheme

UK

Loomis

Türkiye

Magyar Nemzeti Bank

Hungary

ManageCash

Turkey

Money Museum of the National Bank of Georgia

Georgia

Moneycorp

UK

Monnaie de Paris

France

Natwest Group

UK

Norges Bank

Norway

Orell Füssli Security Printing

Switzerland

Orfix

Germany

Red Rose

Ireland

Reserve Bank of Australia

Australia

Robert Schuman Institute, University of Luxembourg

Luxembourg

Rohrs and Associates

South Africa

Royal Canadian Mint

Canada

SBV Services

South Africa

Schuler Group

Germany

Sesami

Canada

Shpun

UK

SICPA SA

Switzerland

Sonect

Switzerland

SURYS – IN Groupe

France

The Blond Group

UK

The Brandenburg Institute for Society and Security (BIGS)

Germany

VakifBank

Turkey

Volumatic

UK

Weiden Technical University of Applied Sciences

Germany

Yapı Kredi

Turkey

Programme

Monday 6 November 2023

Click on presentation to access further information.

Research Seminar is Cash a Public Good? Is Cash a Basic Right?

The two main criteria that define a public good are that it must be non-rivalrous and nonexcludable. Non-rivalrous means that the goods do not dwindle in supply as more people consume them; non-excludability means that the good is available to all citizens.

Access to the presentations is limited to FOC 2023 attendees, please use the password which was provided by the events@recon-intl.com

13:30 Opening Remarks

13:45 Session 1

Is Cash a Public Good or a Basic Right? Understanding the State of the Debate

Héctor Labat

CashEssentials (France)

Money for Nothing? – Is Cash all Private, or does it Qualify as a Public Good?

Tim Stuchtey

The Brandenburg Institute for Society and Security (BIGS) (Germany)

15:30 Break – Refreshments

16:00 Session 2

Uncovering the Digital Payment Divide: Understanding the Importance of Cash for Groups at Risk

Carin van der Cruijsen

De Nederlandsche Bank (The Netherlands)

The Stabilizing Role of Cash in times of Uncertainty and Crises

Franz Seitz

Weiden Technical University of Applied Sciences (Germany)

17:50 Closing Remarks

Tuesday 7 November 2023

09:00 Setting the Scene

Welcome Message

Osman Cevdet Akçay

Central Bank of Türkiye (Türkiye)

Overview and Challenges of the Turkish Cash Cycle

Berk Yücel Balkiz

Central Bank of Türkiye (Türkiye)

10:20 Session Q&A

10:45 Break – Refreshments

11:15 – Understanding the Cash Paradox

The Demand for Cash in Turbulent Times: A Global Update

Antti Heinonen

Bank of Finland, External (Finland)

Factors Determining the Cash Demand Patterns in the Eurozone and Hungary

Ildikó Ritzl-Kazimir

Magyar Nemzeti Bank (Hungary)

12:20 Session Q&A

12:45 Lunch

14:00 Round Table Conversations

In these workshops, participants will deploy their collective intelligence to assess and discuss some of the key challenges and opportunities facing the future of cash. The workshop will offer the opportunity to analyse the burning questions, ranging from declining transactional demand for cash; the need for a more resilient cash cycle in a multi-crises environment or the loss of privacy in a less-cash environment. The workshop will take participants beyond deterministic extrapolations and techno-fatalism to examine changes that are inspired by open and creative futures.

The Round Table topics will include:

- Access to Cash

- Acceptance of Cash

- Redesigning the cash cycle

- CashTech and Innovation

- Cash & CBDC

- Cash and Crises

- The environmental sustainability of cash

- How to fund the cash cycle

- Data management

15:35 Break – Refreshments

16:00 The Cash Cycle in a Digital World

Innovation in the South African Cash Cycle

David Little

SBV Services (South Africa)

Solly Bellingan

BankservAfrica (South Africa)

The Environmental Footprint of Cash in the €-Zone

Christophe Baud-Berthier

Banque de France (France)

17:30 Session Q&A

17:55 End Day One

Wednesday 8 November 2023

09:00 Redesigning the Cash Cycle

Cash of the Future

Katrina Brendle

Deutsche Bundesbank (Germany)

Kerstin Lorek

Deutsche Bundesbank (Germany)

10:05 Session Q&A

10:25 Takeaways from the Round Table Conversations

10:55 Break – Refreshments

11:25 Resilience by design

The Need for Cash in Times of Crisis – A Concept to Strengthen the Resilience of the Cash Cycle

Tim Stuchtey

The Brandenburg Institute for Society and Security (BIGS) (Germany)

The Commercial Cash Market in Türkiye & Garanti BBVA’s CIT Business

Alper Sayin

Garanti BBVA (Türkiye)

Humanitarian Cash & Disaster Resilience

James Shepherd-Barron

Disaster Risk Management Consultant (UK)

12:25 Session Q&A

12:50 Lunch

14:05 Workshop – The Best Defence is Offence: Pioneering a Cash Narrative to Defeat Cashless Propaganda

Brett Scott

Monetary Anthropologist

The digital payments industry invests heavily into turning the public against cash, and they currently dominate the narrative about the future of money. To counter this, we must step outside the terms of the debate that they have set down and reframe cash as a crucial future-facing form of money that will only get more important with time. In this workshop we’ll brainstorm framings, arguments and slogans that will catch the imagination of the public.

15:20 Break – Refreshments

15:50 CashTech : how to Boost Innovation in the Cash Cycle?

Cashtech is the encounter of cash and technology. It brings together innovative companies who leverage software and new communications technologies to improve cash services, including access o cash for consumers and businesses; facilitating the acceptance of cash across by retailers across all channels; enhancing the overall efficiency, resilience and sustainability of cash.

The panel will discuss the latest developments and trends in the CashTech space as well as the regulatory and competitive barriers faced by new entrants in the cash space.

Barry Röhrs, Röhrs Associates

Miguel Lopez, Banco de España

Sandipan Chakraborty, Sonect

16:30 Session Q&A

16:55 CashTech Innovation Awards

The CashTech Innovation Awards will celebrate the huge advances being made in harnessing digital technology to ensure an accessible, reliable and sustainable future for cash. There are three categories.

- Best CashTech – open to all organisations

- Best CashTech Innovator – open to start-ups and companies founded after 2016

- Best CashTech Start-Up – open to start-ups companies founded after 2020